Making Cents Of Money: Financial Literacy For Kids

Advice from Dana Miranda of Healthy Rich + 5 children's books (or is it 8?) to get you started

Hello! I'm Sri Juneja and this is my children’s book recommendation newsletter. You can subscribe by clicking on this handy little button:

Let’s get going…

With so many holidays upon us (our family’s biggest holiday—Diwali—is just around the corner), the spendiest time of year is in full swing. Between birthdays, holidays, and the rising cost of, well, everything, it’s peak take-all-my-money season. Although those of you with kids will agree that, since Day 1, it’s basically been an open bar on anything and everything kid stuff. The complete 180° of my IG-sponsored ad content has given me whiplash.

Growing up, we were squarely middle-class. We could afford all the things we needed and several of the things we wanted but it wasn’t without penny-pinching and planning carefully. Being an immigrant family, we scrimped and saved to take a trip back home to India every three years (this was the era where every flight ticket was ~$1200 which in today’s dollars is $2,300). That meant I only had one really “big” vacation growing up: Disney World. Used to long transatlantic flights, it was the first time I realized flights could be short.

Having benefited from my parents’ sacrifices, our fortunes improved. And yet, even now, so much of my relationship with money is rooted in how I grew up. Today we call it a “scarcity mindset.” I didn’t even know the term “delayed gratification” existed until well into my late teens. We didn’t know delayed gratification was something people would actively choose to do to manage their spending. It was something we had to do.

Now, as my kid becomes increasingly vocal about her desires, I’m left wondering what I’m supposed to do. We fortunately can provide more than how I grew up which begs the question what money values do I instill? How do I “teach” delayed gratification? Is that something I even want to teach? Heck, how do I teach anything about money?

I reached out to Dana Miranda, founder of the Healthy Rich newsletter and Certified Educator in Personal Finance (CEPF), to share her wisdom. Her content has really resonated with me. I love the openness of her views towards money. It isn’t bound by what you should or shouldn’t do but focuses instead on figuring out how to think about money within the context of your own values and lifestyle. Her writing investigates how capitalism impacts the ways we think, teach, and talk about money. She calls out how significant social and economic barriers can be to “playing the money game” and how uninclusive financial education is.

Here’s what she has to say (at the end I’ve listed a few kid’s books that can help you get these conversations started with your kids)…

Is the best way to teach money management by introducing personal finance classes to our education system?

It’s true that personal finance doesn’t get much attention in schools. Most states have passed legislation mandating financial education as a high school graduation requirement. However low standards for financial education mean what satisfies those requirements is inconsistent, and disparities in education funding mean lower-income communities get lower-quality financial education, in keeping with disparities in education across subjects.

Studies have also shown that increased access to financial education doesn’t necessarily mean improved financial circumstances later in life. Racial and class disparities in so-called financial literacy remain even among adults who had equal access to financial education in high school.

I think we all innately know what’s best for us, but the real barrier with money is we don’t understand how our financial products and systems work so we don’t know the real impact of certain money moves. Even when teaching personal finance in schools, it tends to focus on restrictive budgeting rules and debt shaming to teach students a limited “right” way to manage money.

What we need, instead, is financial education that teaches us how bank accounts, debt products, and investment accounts work, so students can make informed decisions in line with the life they want to live.

At what age should parents and caregivers start teaching kids about finances?

Money is always part of life, so it’s always appropriate to help kids be aware of it and to learn to understand their relationship with it, just like you do with food. You begin with developmentally appropriate concepts. Also, just like with food, it’s important not to teach a mindset of restriction or shame around money by creating unnecessary rules or expectations.

Don’t be afraid to tackle big topics, like capitalism or debt or economic inequality, with kids; find ways to put it into language they understand. For example, you might encourage a collective mindset about toys with elementary schoolers while you talk about credit card APR with a high schooler.

How do you recommend we start teaching kids about money and finances?

The best way to help kids in your care have a healthy relationship with money is to model one yourself. That’s something you can do regardless of your financial circumstances. Reflect on your relationship with money, so you can bring that understanding into conversations you have with kids.

The most important lesson kids need to learn about money—as with anything—is to trust themselves. Rather than handing them a budget or set of rules for how to use money, guide them in listening to their needs and using money in ways they decide are right for them.

With younger kids, you can cultivate this mindset without involving money at all; teach kids to trust themselves through decisions they make about play, what to wear, and when to eat, for example. Once they know how to count and recognize different bills and coins, you might give them cash and show them how money relates to the things and experiences in the world. When they have the ability for more abstract thinking, replace the cash with debit and credit cards and start teaching them how financial products work. (Google it with them, so you share accurate information and learn something new yourself!)

Are there certain tools you recommend to help educate kids on financial literacy?

For the mindset work, I recommend Good Inside* by Dr. Becky Kennedy, which is a guide to setting kids up for self-regulation, confidence, and resilience. Fat Talk* by

is also a must-read; it’s about raising kids in diet culture and dealing with anti-fat bias (Sri: my kid’s book recs about body image and body positivity can be found here), which shares a ton of parallels with the way we approach money as a society, what I call budget culture.For specific financial information, Next Gen Personal Finance is a rich source of tons of resources to teach kids about money at various ages. It’s designed for teachers, not parents, but resources are free for anyone to access. You don’t have to do worksheets with kids at home but you can browse the resources by topic (e.g. bank accounts) and find videos and articles that explain how financial products and systems work in easy-to-understand language.

Adults and teens can also learn the fundamentals of my budget-free framework through my online class, where I mix both mindset and information to add ease to financial decision-making.

Books to get kids started on the path of financial literacy…

A Moneybunny Book Series

Written and Illustrated by Cinders McLeod

Recommended Ages: 3-6 years old

An adorable little series focusing on bunnies in Bunnyland where the currency is carrots (Duh.). The four books in the series cover the major money topics in a very digestible way: the concepts in the story are simple and easy to understand. Each of the main characters in the books definitely has the energy, excitement, and precociousness of toddlers and preschoolers, so it’s very relatable to that age set. As an adult, what I appreciated the most was the focus on trade-offs. Each story showcases that to gain something, you need to give something, and some of those things are intangible. It never veers into money management philosophy and approaches (You lucky duck, you! That’s your job.) and instead establishes the fundamentals in an age-appropriate way.

Buy now*: Give It! | Earn It! | Save It! | Spend It!

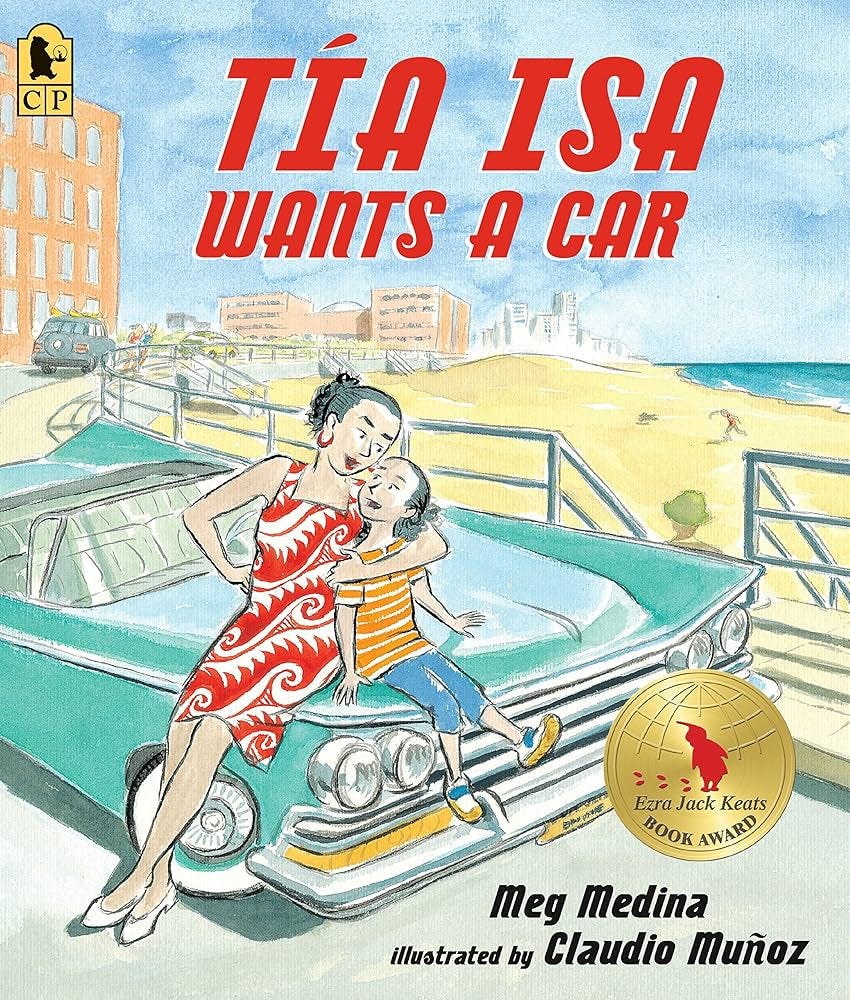

Tía Isa Wants A Car

Written by Meg Medina and Illustrated by Claudio Munoz

Recommended Ages: 4-8 years old

This gorgeously illustrated book is a reminder that money is ultimately a tool. There’s the thing you can buy but what it signifies can be worth so much more. A little girl lives with her Tía Isa and Tío Andrés. They are an immigrant family yearning and waiting for the rest of their family to join them. Tía Isa wants a car that will carry their entire family to the beach by the sea. The beautiful pencil and watercolor illustrations evoke the hot, sticky days of summer and city living. You can feel the freedom the car represents from the sweaty claustrophobia of riding a packed bus. Written in simple, flowing language, the underlying hope is suffused deeply within the teasing laughter between aunt, uncle, and niece and the heartache of missing loved ones from afar. This line in particular stuck with me:

“But soon is when our family is going to join us here, so I know soon can be a very long time.”

It’s a beautiful, moving read that demonstrates how money can be a way to realize a dream.

Buy now*

The Money Tree

Written by Sarah Stewart and Illustrated by David Small

Recommended Ages: 4-8 years old

Where Tía Isa Wants A Car is about using money in pursuit of a goal, this book is about the corruption that money can evoke (two sides of the same coin?). Miss McGillicuddy is a slow-living homesteader who peers out the window one January day and notices an unusual tree beginning to grow on her property. She doesn’t give it much thought. One day in May, she realizes that the leaves on the tree are in fact dollar bills. Over the course of a year, we witness all the characters that show up to have a look at the tree and, of course, take a few “leaves.” As the hubbub around the tree grows, Miss McGillicuddy decides to do something about it. Like the main character, the watercolor illustrations are warm and inviting but also quiet and calm. The grace with which our protagonist lives her life is beautifully mirrored in the illustrations. This book serves as a lovely reminder that enough is just the right amount and that life is so much more than money. A great discussion prompt would be to ask kids why they think Miss McGillicuddy did what she did.

Buy now*

Pigs Will Be Pigs

Written by Amy Axelrod and Illustrated by Sharon McGinley-Nally

Recommended Ages: 5-8 years old

Okay, I really like this book. But I just don’t understand the title. What does “pigs will be pigs” mean? Is there some inside joke here that I’m just not getting? If someone can explain it to me, I’d much appreciate it (please and thanks). The Pig family has decided to go out for dinner but when they realize they don’t have enough money to go out, the family decides to put on their thinking caps and go through every corner of the house to find “free money.” Finally able to scavenge enough, they head out to Enchanted Enchilada (this name absolutely tickles me—how could you not want to dine at this fine establishment?!). This is really a lesson in money math masquerading as a funny story about a hungry family of pigs. The best way to read it is to encourage your kids to total up the amount of money the Pig family finds. Ask kids what they would order from the Enchanted Enchilada menu with the Pig family’s money. Adults might want to do the same (crying in inflation dollars).

Buy now*

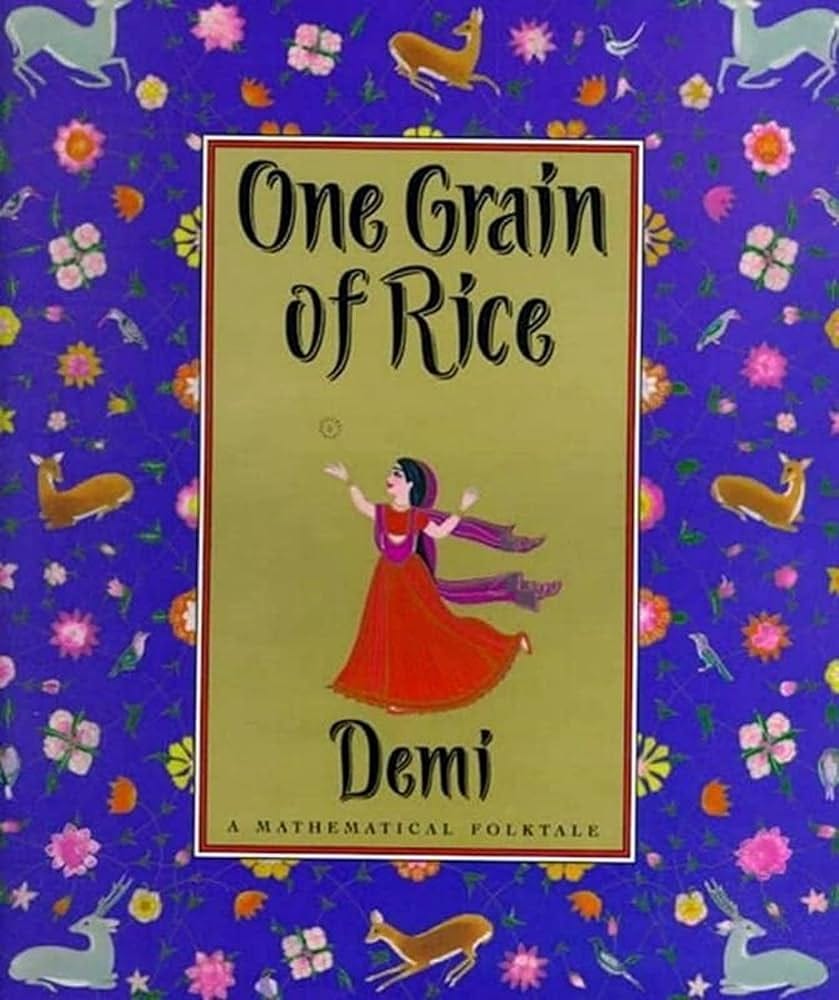

One Grain of Rice

Written and Illustrated by Demi

Recommended Ages: 7-10 years old

Awarded Hall of Fame status by the Mathical Book Prize, this traditionally illustrated folktale does a clever job of explaining exponential growth (and, by extension, compounding). When I first got the book, I was struck by the use of traditional artwork from the time of the Mughal empire in India. This folktale tells the story of a greedy raja (king) who collects all the rice his subjects have grown and promises that he will distribute it should there ever be a drought. When drought befalls them—wait for it—the raja does nothing. A village girl, Rani (interestingly that translates to “queen”), realizes she needs to do something. Using her cleverness (and superior understanding of exponential growth), she forces the raja to distribute rice and saves the people from famine. The illustrations are lush and gorgeously reminiscent of that time period—but, more importantly, they do a wonderful job of showing how exponential growth works. There are so many lessons in this book that are worth discussing: the notion of greed and equity, taxes, and, of course, math.

Buy now*

What sort of money conversations do you have in your family (be it amongst adults or with kids)? Is this something you’ve thought about?

Did you like this newsletter?

Then you should subscribe here:

*Thank you for using (at no additional cost to you) the affiliate links in this post! :-)

Thanks for this post! I always enjoy your book selections and thanks for the Healthy Rich recommendation.

Very helpful post. Yesterday one of my kids was dealing with a lot of frustration about having spent his allowance only to discover something he wanted to purchase on his game. He asked for credit from us for next month's allowance. Always helpful to have more resources to talk about money. Also excited to check out Healthy Rich.